Interest rate rises by 0.75% – Are you worried about the increase?

Thursday 3 November, 2022

The Bank of England is continuing its efforts to reduce the rate of inflation and has today increased the bank base interest rate again, from 2.25% to 3%. These recent regular increases are beginning to have a more profound effect on the mortgage rates that are available, including those available to landlords requiring buy to let mortgages or remortgages.

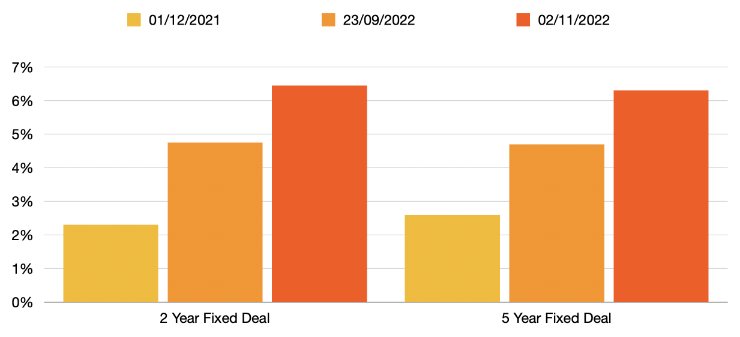

These interest rate rises are clearly illustrated in the graphic below that shows how fixed rate mortgages have risen from just over 2% at the end of 2021 to over 6% by November 2022. Mortgage rates may rise further given today’s rate hike. Thomas Oliver recommend speaking to a mortgage adviser to discuss your circumstances and any financial concerns that you may have.

Source: moneyfacts.co.uk

With further expected interest rate rises in the coming months, what can landlords do to reduce the impact on their property investments?

Plan mortgage changes in advance

It is worth following the market activity on a regular basis to ensure sure that you can more accurately plan your next buy to let mortgage deal months in advance. In the majority of cases, mortgage lenders will provide you with an offer for your new mortgage rate six months before the end of your existing deal.

Assess your mortgage costs

Despite the possibility of having to pay an exit fee, you may find that, in the longer term, it is worth ending your current deal early. You can then pay the early repayment fee and opt for a new mortgage deal at a lower interest rate than one that may be available in the future.

Seek the right mortgage advice

It is important to work with a professional mortgage broker who will be able to offer expert advice while being able to review your options and ensure you get the most suitable buy to let mortgage deal or home owner remortgage deal to fit your needs.

Tracy Dove, Financial Consultant, Mortgage Broker & Protection Adviser in Laindon & Basildon, Essex and Exeter, Devon said:

“Our professional mortgage brokers are experienced in reviewing and assessing buy to let mortgages. By truly understanding our clients’ individual circumstances we can offer professional mortgage advice to both experienced landlords but also to those new, first-time landlords looking for an investment opportunity. We always source the most suitable buy to let mortgage options to match their situation.”

If you would like to find out more about buy to let mortgages and home owner remortgages, please give one of our mortgage brokers a call now on 01707 872000, for a personalised consultation to discuss your requirements.