Omnis Managed Portfolio Service – Monthly Update

Tuesday 14 December, 2021

Burcu Kaya reviews the Omnis Managed Portfolio Service. Omnis Investments is a specialist investment company providing high quality investment solutions. Their funds are available exclusively through the financial advisers of Openwork Limited and 2Plan Wealth Management. Thomas Oliver is a client of Openwork Limited, so our customers benefit from the investment expertise of Omnis managers.

How is the new Omicron coronavirus variant going to affect investment markets?

The new Omicron coronavirus variant that emerged in South Africa has sparked alarm around the world over fears it could be more contagious than other variants and resistant to vaccines. Oil prices and stock markets tumbled over concerns the fast-spreading strain could slow the global recovery. Many countries, including the UK, have also banned travel from countries in Southern Africa, while Israel, Japan and Morocco have all closed their borders to outside travellers.

New lockdowns could pose a threat to growth, while there could be further inflationary pressure from the labour market if people don’t or aren’t able to return to work and wages rise as result. If people decide to remain home this could also raise demand for goods and push up prices even further. While there are fears Omicron could render existing treatments less effective, the good news is that Moderna and Pfizer have said they could quickly tweak their vaccines.

Omicron also risks a new headache for the world’s central bankers who are having to deal with record rates of inflation. The threat of the new coronavirus variant means there is now some doubt that the Bank of England will raise interest rates in December. It has also cast a shadow over the Federal Reserve, the US central bank, accelerating a wind-down of its stimulus and the plans of the European Central Bank (ECB) to ease its stimulus measures. With so much still unknown about this new variant of the virus and the impact it may or may not have on the economic outlook, we will provide further updates as we learn more.

Record-high inflation

US inflation hit a 31-year high in October of 6.2%, while Britain’s annual inflation rate jumped to 4.2%. The euro zone’s inflation rate also rose to a record high in November of 4.9%. We still agree with central banks that the rise in inflation will be transitory. The impact of supply chain bottlenecks and higher energy costs which are driving inflation should reduce over time.

US economic growth slowed to a modest annual rate of 2.1% in the third quarter of the year, reflecting a drop in consumer spending. However, economists are predicting a rebound as long as rising inflation and Covid cases do not derail activity. Britain’s export performance is slipping behind other developed countries, while the economic recovery is also slowing. Combined with supply chain disruption and a shortage of workers, we think the growth outlook is looking less favourable for the UK.

Asset allocation

The strengthening dollar has hurt emerging markets by putting pressure on them to raise interest rates to defend their currencies, which in turn slows growth. Low vaccination rates have also hit economic growth, while supply constraints are preventing exports from getting through. China’s regulatory crackdown on socially bad sectors has triggered issues in the housing market, which has had ramifications for the economy. Its zero-Covid policy, likely to remain in place until the Winter Olympics, also makes it difficult to keep economic output high.

The strengthening dollar has hurt emerging markets by putting pressure on them to raise interest rates to defend their currencies, which in turn slows growth. Low vaccination rates have also hit economic growth, while supply constraints are preventing exports from getting through. China’s regulatory crackdown on socially bad sectors has triggered issues in the housing market, which has had ramifications for the economy. Its zero-Covid policy, likely to remain in place until the Winter Olympics, also makes it difficult to keep economic output high.

Investment strategy - Omnis Managed Portfolio Service

Rising inflation and the emergence of the Omicron variant means the global outlook continues to remain uncertain. The market dip following the discovery of the new variant highlights the importance of having a well-diversified portfolio, which can help manage risk and reduce the volatility of portfolios when things get difficult. That is why it is important to be invested in a diversified portfolio in line with your attitude to risk.

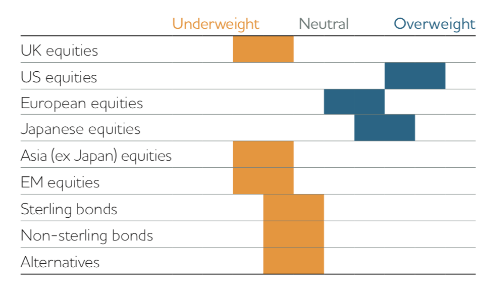

We remain underweight to UK, Asia (ex Japan) and emerging market equities due to the deteriorating economic and policy outlook. Relative to other markets, Europe and Japan are better placed for growth, so we have a moderately overweight allocation. With the US economic outlook continuing to look strong, we remain overweight in US equities.

Our exposure to fixed income assets remains moderately underweight due to low yields. We’ve maintained our exposure to gilts, even though they have low yields, as they offer protection against equity market volatility.

Contact our experienced financial advisers for investment planning advice

If you require investment advice and want to discuss the Omnis investment range, please contact our Thomas Oliver financial advisers based in Cheshunt, Hertfordshire on 01707 872000. Our financial consultants offer our clients based in Hertfordshire, Essex, North London, and Central London a personalised financial planning experience.

Issued by Openwork Wealth Services Limited (OWSL), which is authorised and regulated by the Financial Conduct Authority. Registered address: Washington House, Lydiard Fields, Swindon SN5 8UB.

This update reflects OWSL’s view at the time of writing and is subject to change. The document is for informational purposes only and is not investment advice. We recommend you discuss any investment decisions with your financial adviser. OWSL is unable to provide investment advice. Every effort is made to ensure the accuracy of the information but no assurance or warranties are given. Past performance should not be considered as a guide to future performance.