Planning for the Future: Understanding Pensions and Retirement in the UK

Thursday 28 August, 2025

In the realm of personal finance, pension planning for retirement is a crucial aspect that requires careful consideration and informed decision-making.

Mark Cornes, Financial Adviser & Pensions Adviser in Bristol, said:

“For individuals in the UK, understanding pensions and retirement planning is essential to ensuring a comfortable and secure future. In this article, I outline the key considerations around pensions and highlight the importance of seeking regulated financial advice tailored to your needs.”

Types of Pensions

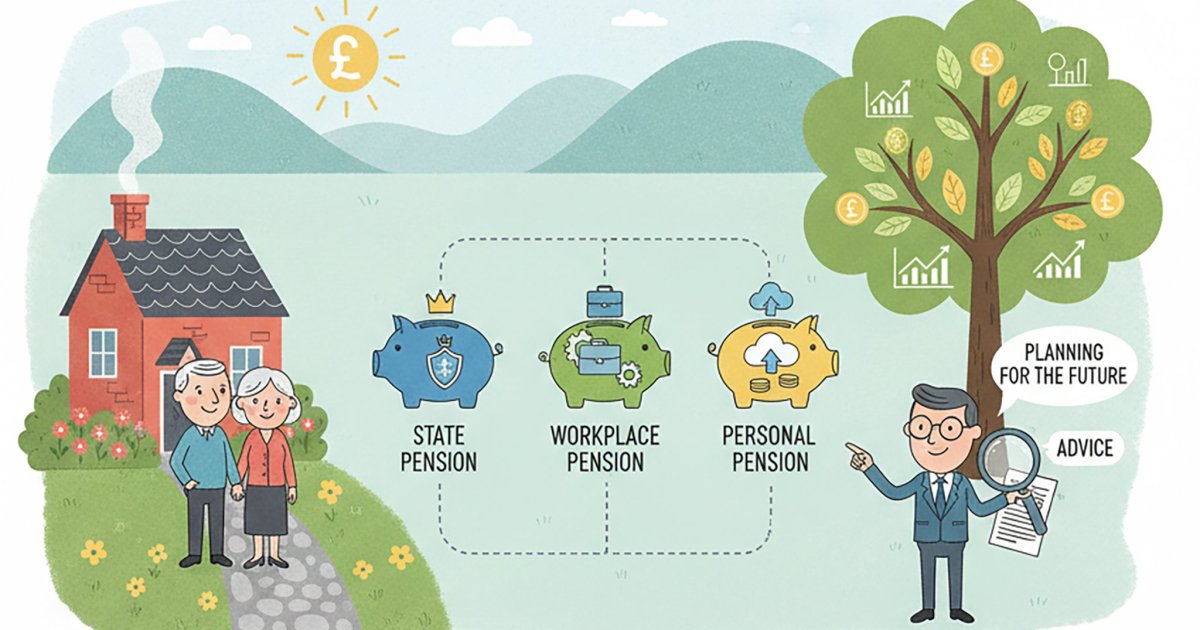

Pensions are central to long-term financial planning, offering income and stability when full-time work ends. In the UK, the three main types of pensions are the State Pension, Workplace Pensions, and Personal Pensions.

- The State Pension is provided by the government and based on National Insurance contributions. From April 2025, the full new State Pension is £230.25 per week. To receive the full amount, individuals typically need 35 qualifying years of National Insurance contributions. Those who reached State Pension age before April 2016 may be entitled to the basic State Pension, which is now £176.45 per week based on 30 qualifying years.

- Workplace Pensions are arranged by employers. Employees contribute part of their salary, often matched or supplemented by their employer. Under automatic enrolment rules, the minimum total contribution is 8% of qualifying earnings (between £6,240 and £50,270 per year), with at least 3% coming from the employer.

- Personal Pensions are arranged by individuals through pension providers. These schemes allow flexible contributions and investment choices. As with any investment product, the value of a personal pension can go down as well as up, and you may not get back what you paid in.

The Importance of Early Planning

Starting pension contributions early can significantly improve long-term outcomes. Compound growth over time has the potential to increase savings, making early contributions advantageous.

Planning ahead also enables a more diversified investment strategy, which can help manage risk. Understanding the effect of inflation on future purchasing power is equally important. In 2025/26, the State Pension was increased by 4.1% under the triple lock mechanism, reflecting average earnings growth.

Regularly reviewing pension contributions in line with inflation and lifestyle changes can help you stay on course toward your retirement goals.

Steps to Effective Retirement Planning

- Assess Your Current Financial Position: Evaluate your income, spending, debts, and current savings. This provides a foundation for building your retirement strategy.

- Set Retirement Objectives: Define the lifestyle you’d like to have in retirement and estimate the associated costs. This might include everyday living expenses, travel, healthcare, or other personal goals.

- Estimate Your Retirement Fund Requirement: Use online retirement calculators as a helpful starting point, but keep in mind that these tools do not replace personalised advice from a regulated professional.

- Select an Appropriate Pension Scheme: Depending on your employment and personal circumstances, you may contribute to a workplace pension or set up a personal pension. Each type offers different tax reliefs and contribution rules.

- Contribute Regularly and Monitor Progress: Maintaining consistent contributions and reviewing performance over time is important. Adjusting contributions to reflect changes in earnings or circumstances can help keep you on track.

Consulting Financial Advisers

Navigating pensions and retirement options can be complex. It is strongly recommended to speak with a financial adviser who can assess your specific needs and goals, and provide suitable guidance under current pension legislation.

Our team of FCA-regulated financial advisers offers tailored, professional advice to help you understand your options, manage pension contributions, and make informed investment decisions.

Mark Cornes, Financial Adviser & Pensions Adviser in Bristol, said

“Effective retirement planning is an ongoing process. It involves understanding the available pension options, starting contributions as early as possible, and regularly reviewing your long-term goals. Seeking professional advice ensures that decisions are informed and aligned with your future plans.”

Important Information and Disclaimers: This content is for information purposes only and does not constitute financial advice. Any figures or references to tax benefits or legislation are based on current understanding of UK law as of June 2025 and may be subject to change. Financial advice should only be provided by individuals or firms authorised and regulated by the Financial Conduct Authority. Please speak with a regulated adviser before making any decisions about pensions or retirement planning.

Sources

- bbc.co.uk/news/articles/cq6m03ld7nvo

- gov.uk

- gov.uk/government/news/huge-income-boost-for-millions-of-pensioners-and-working-people

The value of investments and any income from them can fall as well as rise and you may not get back the original amount invested.

Past performance is not a reliable indicator of future performance and should not be relied upon.

Thomas Oliver UK LLP is an appointed representative of The Openwork Partnership, a trading style of Openwork Limited which is authorised and regulated by the Financial Conduct Authority.

Approved by The Openwork Partnership on 20/08/2025.