Searching for the right mortgage deal when house prices are falling

Tuesday 12 September, 2023

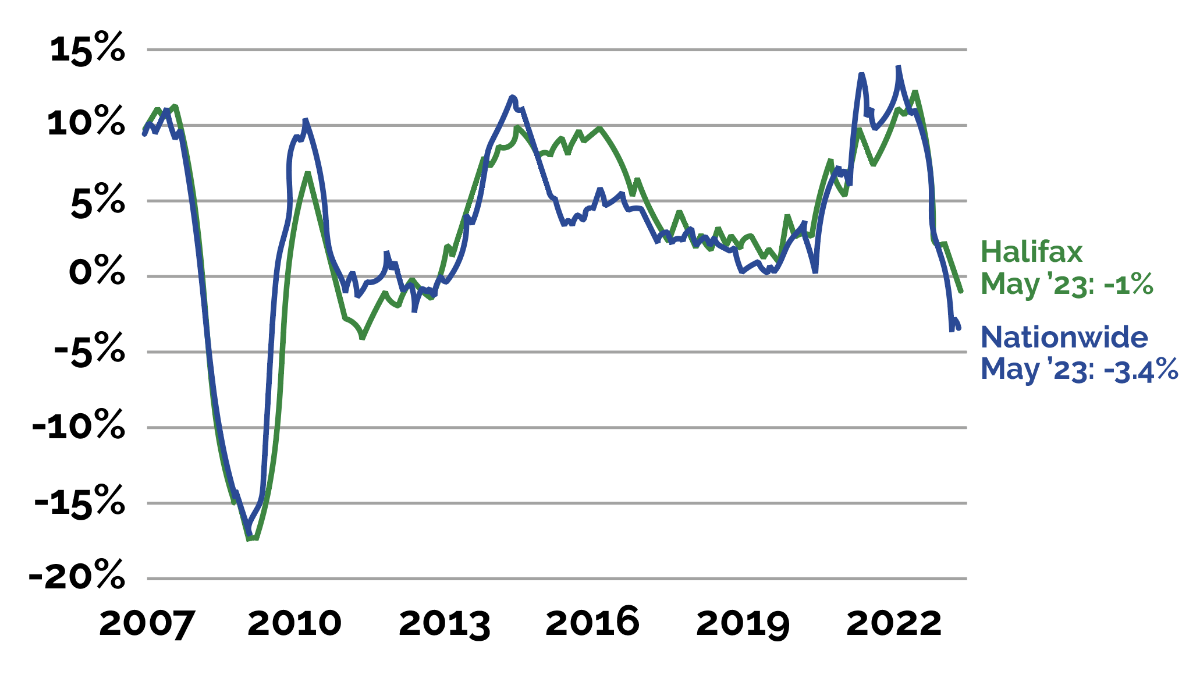

House prices in the UK have continued to fall, and Halifax have reported a fall of 1% in the year to May. These latest figures follow the sixth consecutive month-on-month fall.

Nationwide, a rival lender, has reported a steeper drop in house prices. The building society said that property values had fallen by 3.4% in the year to May, the biggest decline in 14 years.

In addition, with the increase in interest rates making mortgages less affordable for some, and the increases in the cost of living, it is more important than ever to accurately review your mortgage options if you have made the decision to move.

But how do you decide on the best time to move in order to gain your next home at the lowest possible value?

Merian Gerova, Mortgage Adviser in East Finchley, North London outlines the areas you should focus on in order to get yourself in a prime position to move and utilise the most suitable mortgage deal to meet your needs.

Monitor your local house prices

With any volatility in the housing market, it is always important to study the market fluctuations. Understanding how your local housing market has been reacting to the wider economic pressures will help to determine how you can proceed with your move.

Understanding the trend will give you a better picture of when you could start looking for your next home. Although it is worth noting that it will be incredibly difficult to truly define when the house prices will be at their lowest and then start rising again.

Seek professional mortgage advice

Whilst you are monitoring the market, it will be worthwhile understanding which mortgage deals are available to you. This will include a figure of how much you will be able to borrow. Seeking the advice of a professional mortgage broker will help you determine which mortgage deal is most fitting for your specific circumstances.

Mortgage offers typically remain valid for 6 months, so by having your mortgage in place whilst you are looking for your move will be beneficial when you are ready to make an offer.

Consider a fixed-rate mortgage

If you are concerned about rising interest rates, a fixed-rate mortgage can provide you with peace of mind. However, it is important to note that fixed-rate mortgages typically come with higher interest rates than variable-rate mortgages.

It is also worth bearing in mind that interest rates may start to fall in 2025. Your mortgage adviser will recommend how long to ‘fix’ your mortgage for.

Be prepared to compromise

If you are determined to buy a home in the near future, you may need to be prepared to compromise on your desired property. This could mean accepting a smaller property, or a property in a location that is a little further afield in order to make your move affordable.

It is important to remember that the housing market is unpredictable, and it is impossible to say for sure when house prices will bottom out. However, by following these tips, you can increase your chances of getting a good deal on your next home.

A market ripe for first time buyers?

When house prices are falling, it can be a great time for first-time buyers to enter the market. This is because they will be able to get a better deal on a property, as sellers will be more motivated to sell in order to avoid losing money. However, it is important for first-time buyers to understand how much they can afford before they start looking at properties. They should also do their research, seek advice and find the right mortgage deal for their financial situation.

There are a few things that first-time buyers can do to make sure they are prepared to buy a house when prices are falling.

- Speak to a mortgage adviser to get a mortgage in principle – This will provide an idea of how much they can afford to borrow and will make the buying process go more smoothly.

- Start saving for a deposit – The more money they can put down, the lower their monthly mortgage payments will be.

- Shop around for the right mortgage deal – There are many different lenders out there, so it is important to seek advice and compare rates and fees before choosing a mortgage.

Predictions for house prices in 2024

Predicting how the housing market will change in the coming year is a notoriously difficult prediction to make. Some economists think that there will likely be continued falls over the remainder of 2023 with further falls in 2024. After this there is predicted to be a period of stagnation with minimal growth in 2025.

Despite these predictions, it is important to remember that they are by no means certain. Therefore, remaining fully up to date on all the information concerning mortgages and house prices will remain an important element.

Merian Gerova, Mortgage Adviser in East Finchley, North London said:

“With the fluctuations we are currently seeing in both house prices and mortgage rates, it has shown that seeking professional mortgage advice is as important as ever. Understanding how much you can borrow and having a mortgage in place will help support you in your property search. The Thomas Oliver mortgage broker team are on hand to provide you with all the mortgage information you need.”

If you are seeking advice on the latest mortgage deals that are currently available, then please call our team on 01707 872000 to book your appointment.

Data obtained from https://www.bbc.co.uk/news/business-65825576

Approved by The Openwork Partnership on 11/09/2023.

YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE

This article is for guidance purposes and does not constitute advice.