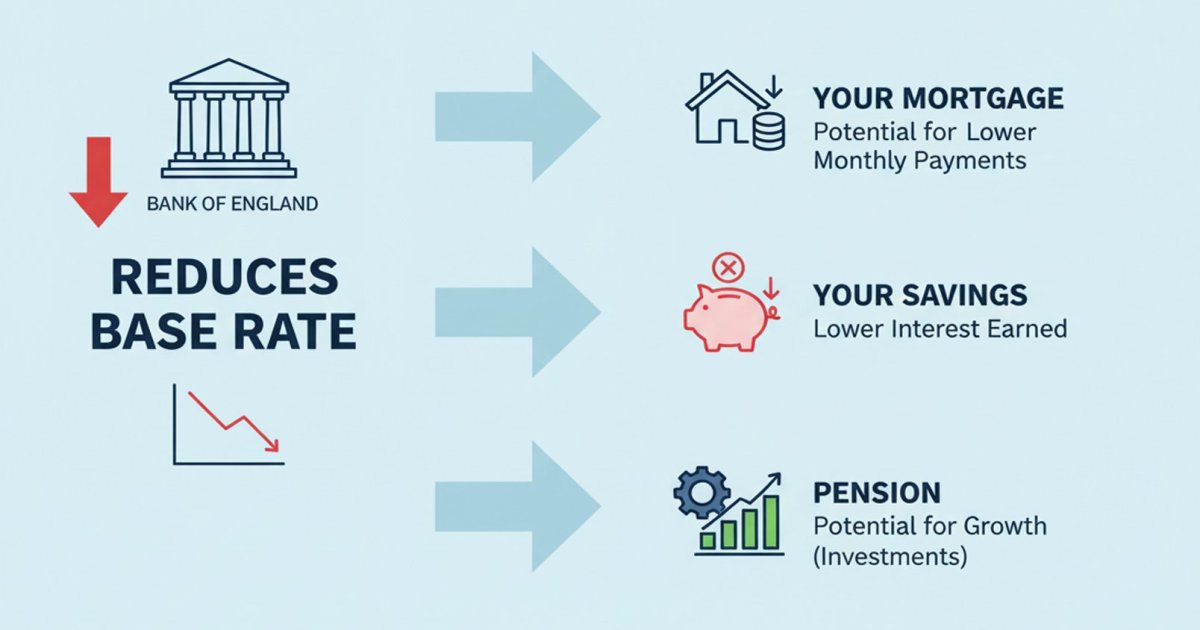

BoE Reduces Base Rate: What It Means for Your Mortgage, Savings & Pension

Thursday 11 September, 2025

On 7 August 2025, the Bank of England’s Monetary Policy Committee voted by the narrowest of margins to lower the Bank Rate by a further 0.25 percentage points, moving it from 4.25% down to 4%.

Policymakers explained that while inflation is still running above the 2% target, the rate of price growth has started to ease, giving them scope to support households and businesses by lowering borrowing costs.

At the same time, Bank officials stressed that future moves would be cautious, with decisions continuing to depend on how inflation and economic growth develop in the months ahead.

What does the rate cut mean if you have a mortgage?

For homeowners, the Bank’s move is particularly significant. If you have a tracker or standard variable rate mortgage, you are likely to notice changes quite quickly. These mortgage products are directly linked to the Bank Rate, meaning that monthly repayments should fall in line with the reduction, providing some immediate breathing space in household budgets.

For example, on a typical £200,000 repayment mortgage, a 0.25 percentage point reduction could save borrowers several pounds each month, adding up to meaningful relief over the course of a year.

However, for those with fixed-rate mortgages, the situation is slightly different. Lenders tend to price these deals based on financial market expectations for interest rates in the future, and many fixed products already incorporate the likelihood of this cut, or even the possibility of further reductions.

As a result, while the news is positive, the impact may not be as pronounced as it is for those on variable arrangements. Nevertheless, the cut may contribute to a wider environment of gradually lower borrowing costs, which could make future remortgaging opportunities more attractive.

Is your mortgage deal coming to an end?

For borrowers approaching the end of their current fixed-rate deal, this could be an important moment to review options. A lower base rate often filters through into cheaper remortgage products, particularly if lenders compete more aggressively for business. This can give homeowners the chance to lock into a new rate that is more affordable than what might have been available only a few months earlier.

However, it is worth noting that while headline rates may fall, affordability assessments and lender criteria remain key considerations, so professional advice can be valuable when comparing deals and ensuring the timing of a remortgage works to your advantage.

John Pringle, Mortgage Broker based in Tottenham and Edmonton, North London, explains:

“For borrowers on tracker mortgages this cut will be felt almost immediately, reducing monthly payments and easing pressure on household finances. For those currently on a fixed rate, much of this change was already expected by the market, but the good news is that competition between lenders remains strong. That can work in favour of homeowners looking to secure a deal that provides both value and long-term peace of mind.”

What does the rate cut mean for your savings?

While mortgage holders may welcome the news, savers face a more challenging outlook. When the Bank of England lowers its base rate, banks and building societies usually follow by reducing the returns they offer on savings accounts.

We are already seeing signs of this, with several high-street names announcing cuts to easy-access and fixed-term savings rates in recent days. For savers, this means the interest earned on deposits may fall, making it harder to generate meaningful growth on cash holdings.

The situation is made more difficult by the fact that inflation is still running above the Bank Rate. This means that even though savers may receive some interest, the real value of their money, the amount it can buy in terms of goods and services, continues to decline. For those relying on savings for income, such as retirees with cash deposits, this can be particularly concerning.

While some niche savings products may continue to offer slightly better rates, the overall direction is downward, underlining the importance of considering whether cash alone is the best place for long-term savings.

What could this mean for pensions?

For pensions, the picture is more complex. Many workplace and private pensions are invested in a mix of assets such as equities, bonds, and property, and the Bank’s decision to cut interest rates has varying effects on each.

Lower interest rates often push down yields on government and corporate bonds, which form a significant portion of many pension funds. This can reduce the immediate income that those assets generate, potentially weighing on the returns of some funds.

On the other hand, lower rates can also support stock markets, as cheaper borrowing encourages investment by businesses and spending by consumers. If equity markets respond positively, pension funds with substantial stock market exposure may benefit over time.

For those approaching retirement and thinking about converting their pension pot into an annuity, the situation may be less straightforward. Annuity rates are influenced by gilt yields, which in turn are affected by interest rate decisions. A sustained period of lower rates could place downward pressure on annuity rates, meaning the level of guaranteed income on offer might fall.

For members of defined benefit schemes, the impact is mainly felt in the way schemes are valued and funded, rather than in immediate changes to the income pensioners receive. Nonetheless, the shift in interest rates highlights the importance of regularly reviewing retirement plans to ensure they remain aligned with long-term needs and market conditions.

In conclusion

The Bank of England’s decision to reduce the base rate to 4% is a clear signal that policymakers are trying to balance the fight against inflation with the need to support the wider economy.

For homeowners, it offers some welcome relief on mortgage costs, particularly for those on variable rates, while for savers it presents a reminder of the challenges of protecting the value of cash in an environment where inflation remains stubbornly high.

For pension savers and retirees, the implications are more mixed, with both risks and opportunities depending on the type of pension and the way investments are structured.

With so many factors at play, this change is a timely reminder of the value of speaking to a qualified mortgage of financial adviser who can help you understand how the Bank’s decision affects your individual circumstances.

Whether you are reviewing your mortgage, looking at savings options, or planning for retirement, personalised guidance can help you make informed choices and give you confidence about the future.

YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE.

The value of investments and any income from them can fall as well as rise and you may not get back the original amount invested.

Approved by The Openwork Partnership on 15/09/2025.

Sources: https://www.bankofengland.co.uk/monetary-policy-summary-and-minutes/2025/august-2025