Don’t wait to move Review our best mortgage rates now...

Tuesday 31 May, 2022

At Thomas Oliver our qualified mortgage brokers are trained to assist you by finding the most appropriate mortgage products and mortgage rates available to you in the mortgage market. We work with first time buyers, home movers and commercial investors purchasing buy to let investments.

If you want to move this summer, or your mortgage deal is coming to an end and you want to know the best mortgage rates available, please check below, or call our mortgage advisors on 01707 872000.

Remember these rates may not be available when you call us but we can always work with you to find the best available mortgage rate when you need it.

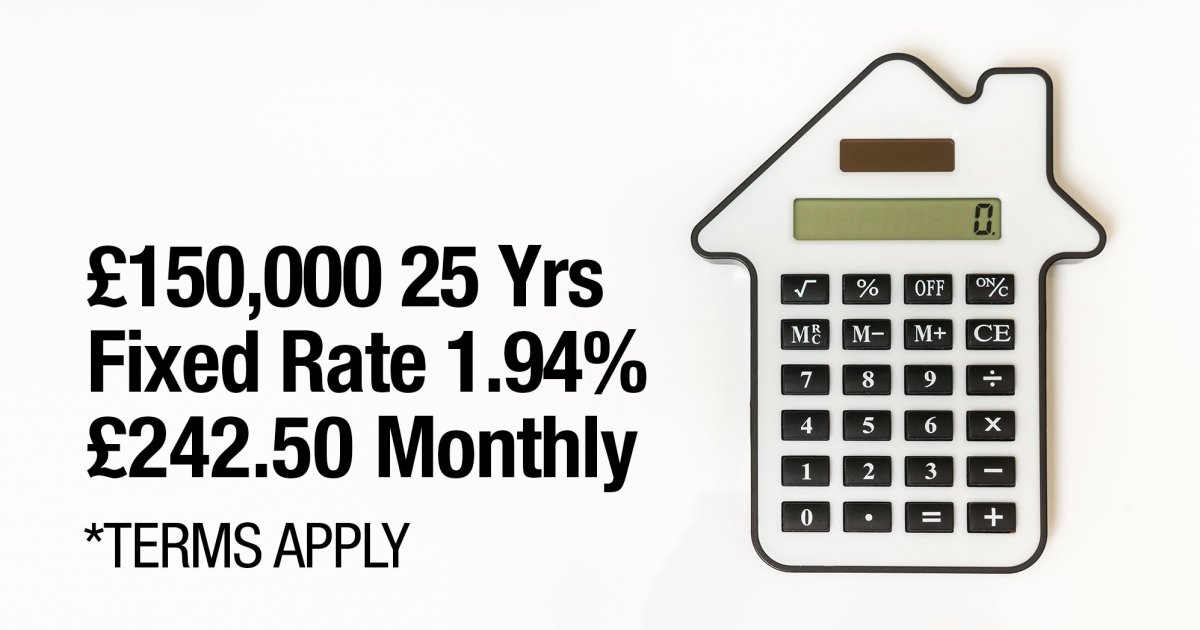

Mortgage Deal – Option 1

£150,000 loan with a 25-year term

Fixed rate of 1.94% until 31.07.24

Monthly Payment £242.50

Early repayment charges will apply until 31.07.24

The overall cost for comparison is 4.6% APRC

For an interest only mortgage you would pay 26 payments at a cost of 1.94% with monthly payments of £242.50, followed by 274 payments at a variable rate which is currently 4.74% with monthly payments of £592.50 Total amount payable £322,100.

The illustration is based on an interest only mortgage.

Mortgage Deal – Option 2

£200,000 loan with a 25-year term

Fixed rate of 1.94% until 31.07.24

Monthly Payment £323.33

Early repayment charges will apply until 31.07.24

The overall cost for comparison is 4.6% APRC

For an interest only mortgage you would pay 26 payments at a cost of 1.94% with monthly payments of £323.33, followed by 274 payments at a variable rate which is currently 4.74% with monthly payments of £790.00. Total amount payable £429,382.

Please note if you are reading this this after 10/5/22 it is possible that these rates may no longer be available.

Our Mortgage Services

Thomas Oliver provides mortgage advice for the following services:

- Mortgages

- Remortgages

- Product Transfer

- Further Advances

- Interest Only Mortgages

- Repayment Mortgages

- Variable Mortgages

- Tracker Mortgages

- Fixed Mortgages

Tracy Dove, financial consultant and mortgage broker and protection adviser in Laindon, Basildon and Essex said:

‘The fixed rate mortgage rates we can offer our clients now are higher than the 0.99% we were offering in early December 2021. However, it is worth remembering that we have experienced four interest rate rises since then, so fixed rate mortgages have got more expensive. With the cost of living increasing for all of us, some clients are taking a fixed rate deal but increasing the term on their mortgage to keep costs the same. If you currently have a variable rate mortgage it is worth considering fixing your mortgage as it may well work out cheaper for you if interest rates rise again due to inflationary pressures. We offer individual tailored mortgage advice so don’t delay call the Thomas Oliver mortgage broking team on 01707 872000 for more information.’

In Summary…

Our mortgage brokers offer you individual mortgage and protection advice, so you always make the right financial decisions for your circumstances. Call our team now on 01707 872000 and arrange your initial mortgage consultation.’

Your property may be repossessed if you do not keep up repayments on your mortgage. Thomas Oliver UK LLP are appointed representatives of Openwork Limited which is authorised and regulated by the Financial Conduct Authority.