Is your mortgage deal ending? View our latest deals

Thursday 25 August, 2022

As The Bank of England have made another interest rate rise in its continued effort to tackle further inflationary concerns, we are now seeing the knock-on effects of the mortgage lenders increasing their standard variable rates in response.

With this latest interest rate rise, it is advisable that you review your current mortgage deal. We highly recommend that you call our Thomas Oliver mortgage broking team on 01707 872000 to help you with your mortgage review, to determine if you have the best mortgage rate possible and that your mortgage is the most suitable mortgage product for your individual financial circumstances.

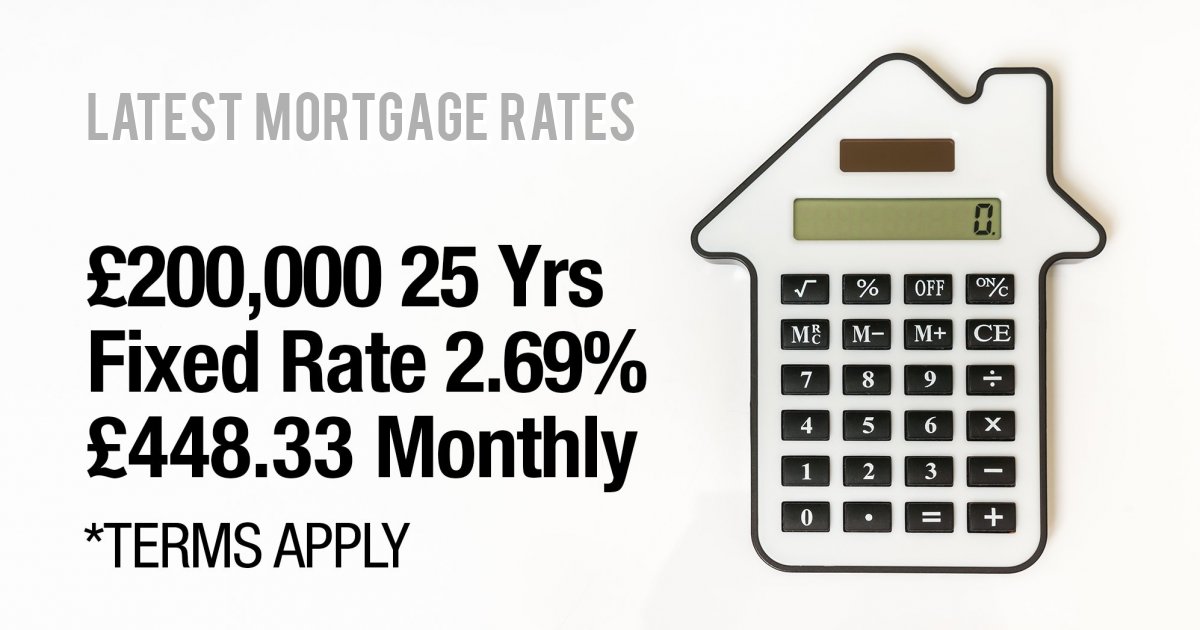

Latest Mortgage Rates August 2022

Please note that these mortgage rates below are only available for a certain length of time, but we can check the market and provide you with a mortgage illustration to suit you.

Mortgage Deal – Option 1

£200,000 loan with a 25-year term

Fixed Rate of 2.69% until 30.09.2024

Monthly Payment £448.33

Early repayment charges will apply until 30.09.2024

The overall cost for comparison is 5.2% APRC

For an interest only mortgage you would pay 24 payments at a cost of 2.69% with monthly payments of £448.33, followed by 275 payments at a variable rate which is currently 5.24% with monthly payments of £873.33 Total amount payable £455,889.

The illustration is based on an interest only mortgage.

Mortgage Deal – Option 2

£150,000 loan with a 25-year term

Fixed rate of 2.69% until 30.09.2024

Monthly Payment £336.25

Early repayment charges will apply until 30.09.2024

The overall cost for comparison is 5.2% APRC

For an interest only mortgage you would pay 24 payments at a cost of 2.69% with monthly payments of £336.25, followed by 275 payments at a variable rate which is currently 5.24% with monthly payments of £655.00. Total amount payable £341,981.

Please note if you are reading this this after 02/08/2022 it is possible that these rates may no longer be available.

Farrukh Jabbar, Mortgage Broker in Walthamstow, East London said:

“We work with a wide spectrum of people who are looking for the best mortgage deal available to them, from first time buyers to home movers through to commercial investors looking to purchase a buy to let investment.

In addition, we also help our clients that are looking to remortgage, many of whom have already been transferred to the lender’s variable rates or those that have a fixed rate mortgage deal that is due to come to an end soon.

We strongly encourage anyone whose current mortgage deal is heading for renewal within the next six months to call us as soon as possible. We can help to find them the mortgage deal most suitable to them. Don’t forget, many mortgage deals offers can last for up to six months so you can organise it now ready for when you need it.”