Looking to move? Review our best mortgage rates...

Wednesday 29 September, 2021

Our mortgage brokers can save you time and money as we are trained to find the best mortgage products available in the mortgage market.

If you want to move this Autumn, review our best mortgage rates below. Please note that these rates may not be available when you enquire, but if you call our mortgage brokers on 01707 872000 we can identify the best mortgage solution for your circumstances.

Mortgage Option 1

£150,000 loan with a 25-year term

Fixed rate of 1.18% until 30.11.23

Monthly Payment £147.50

Early repayment charges will apply until 30.11.23

The overall cost for comparison is 4.7% APRC

For an interest only mortgage you would pay 26 payments at a cost of 1.18% with monthly payments of £147.50, followed by 274 payments at a variable rate which is currently 5.0% with monthly payments of £625 Total amount payable £327,313.

The illustration is based on an interest only mortgage.

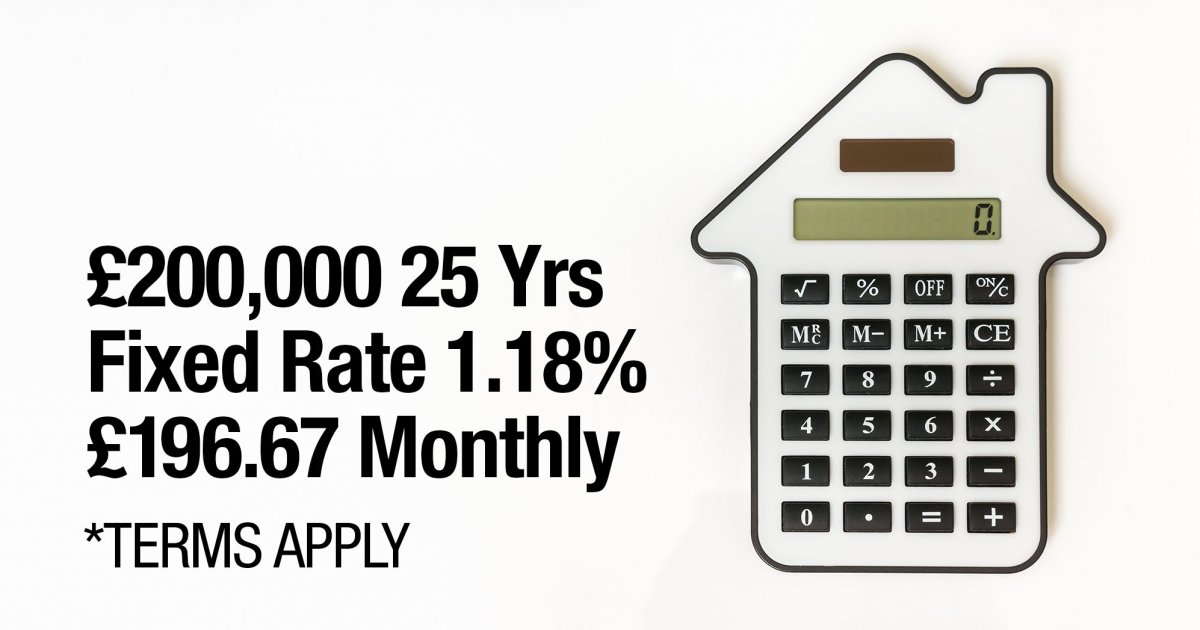

Mortgage Option 2

£200,000 loan with a 25-year term

Fixed rate of 1.18% until 30.11.23

Monthly Payment £196.67

Early repayment charges will apply until 30.11.23

The overall cost for comparison is 4.6% APRC

For an interest only mortgage you would pay 26 payments at a cost of 1.18% with monthly payments of £196.67, followed by 274 payments at a variable rate which is currently 5.0% with monthly payments of £833.33. Total amount payable £435,759.

The illustration is based on an interest only mortgage and is available until 1st September 2021.

Thomas Oliver provides mortgage advice for the following services:

- Mortgages

- Remortgages

- Product Transfer

- Further Advances

- Interest Only Mortgages

- Repayment Mortgages

- Variable Mortgages

- Tracker Mortgages

- Fixed Mortgages

Romany Yousab, Mortgage Broker in Nottingham said:

“The mortgage rates shown are examples of the type of mortgage deals that are currently available. We always recommend that when you remortgage you contact your Thomas Oliver mortgage broker several months before your current deal ends.

For more information on how our Thomas Oliver mortgage advisers can save you time and money when you remortgage read our recent article – Call our mortgage brokers for the best deal when you renew your mortgage. Similarly, if you are moving house you will need to set up your mortgage in advance before your moving date. Our experienced mortgage brokers can work with you to establish your requirements, review your lifestyle by analysing your income and expenses before providing you with the most suitable mortgage advice.

The mortgage rates shown in this article give you an idea of the type of mortgage costs you can currently expect, but our mortgage brokers will review your personal circumstances to find the right mortgage for you. We offer mortgage advice to anyone who needs a residential mortgage, or a buy to let mortgage.

We also specialise in organising mortgages over the value of £1,000,000. For more information read our recent article – Thomas Oliver is a high-net-worth mortgage specialist. Our mortgage consultants are experienced mortgage brokers who have worked with a variety of residential and commercial clients in North London, Essex and Hertfordshire.

Trust our mortgage brokers to find the right mortgage deal for you, call us now on 01707 872000 for an initial mortgage consultation.’

Your property may be repossessed if you do not keep up repayments on your mortgage. Thomas Oliver UK LLP are appointed representatives of Openwork Limited which is authorised and regulated by the Financial Conduct Authority.