Why it pays to stay invested

Thursday 9 September, 2021

Take a long-term view when you invest in stock markets

Many people are put off investing in equity markets because of volatility and concern that stock markets will fall rapidly on negative news.

However, your local Thomas Oliver financial advisers always recommend you invest on a long-term time horizon, normally at least five years. Over the longer-term equity markets have outperformed cash. If you have savings that you want to invest for your retirement, call our local Thomas Oliver financial consultants on 01707 872000. Our qualified financial advisers offer personalised financial advice to clients in London, Hertfordshire, and Essex.

In this article local Thomas Oliver financial adviser Tracy Dove, who works in Basildon, Essex and Exeter, Devon reviews why long-term investing can benefit you and enables you to avoid short-term market price fluctuations. There may never be a perfect time to invest, which is why our financial consultants recommend you regularly invest and use your annual ISA and pension allowance

How negative news affects equity markets and creates volatility

It is easy to put off investing when you consider the constant negative news. Already this year markets have been affected by rising inflation and the spread of the Delta coronavirus variant, and in 2020 when the pandemic began stock markets fell sharply in spring before rising in the second half of the year.

How to cope with a stock market setback

There are many examples, and some of them are very recent showing how markets react to unforeseen events. During the financial crisis the stock market fell, and it took four years for it to recover to pre-crisis levels. The financial crisis of 2008 started in the US because of a housing bubble, and this led to the worst global recession since the 1930’s. At the end of 2008 the MSCI World Index had fallen 19.3%. However, Governments worked together and put supportive measures in place. Interest rates were cut, and support was provided for businesses.

‘Time in the market’ is more important than ‘timing the market’

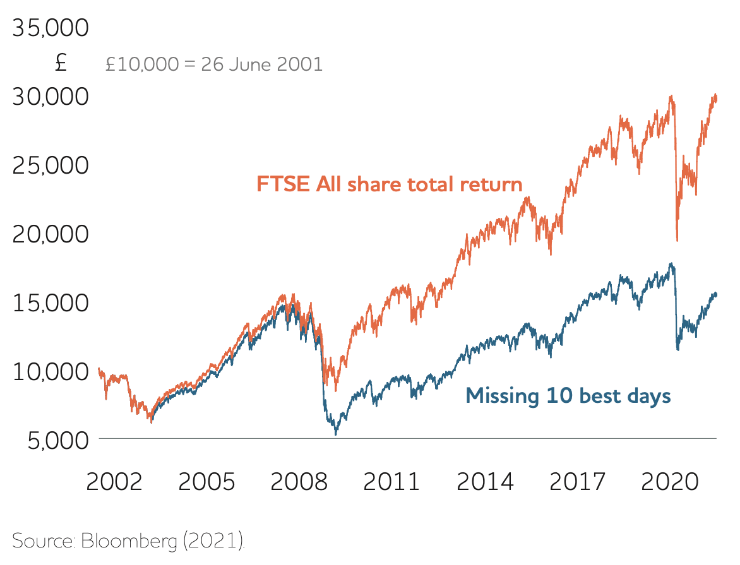

The chart below shows how much a £10,000 investment would be worth if you missed the ten best days of UK equity market performance since 2001.

Equity markets are volatile

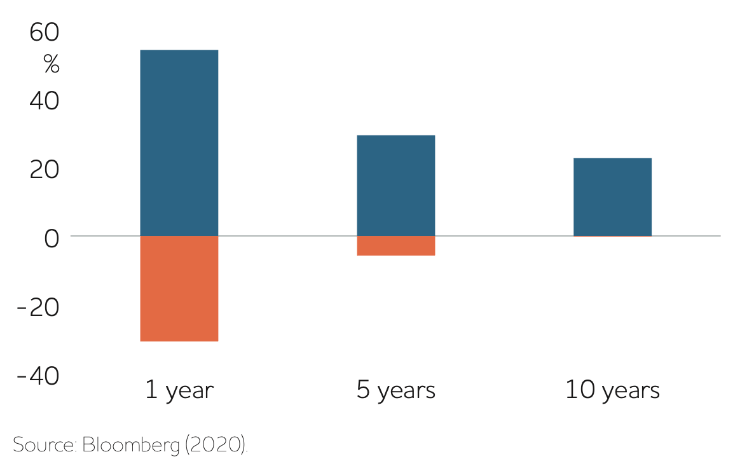

According to returns from the MSCI World Index if you invested your money in world markets in the best year you would have made a return of 50%, but in the worst years you could have lost 30%.

The volatility of equity markets is noticeable but what is also relevant is the importance of not trying to time the market. When stock markets fall it often happens very quickly, but afterwards there are days when the markets bounce very hard. If you sell to reduce your loss timing your re-entry into the market is very difficult.

As the graph demonstrates it is often better to remain invested and ride out any short-term underperformance. Over the last fifty years although there have been difficult times anyone who has kept their money invested for the long-term would have benefited, because historically equity markets have risen over the long-term, it’s only if you just invest on a short-term horizon that you could lose some of your capital. Or if you sell equities and re-enter the market your timing could affect your return.

At Thomas Oliver we recommend that you invest regularly and always invest on at least a five-year time horizon. We prepare our clients for short-term setbacks and encourage them to maintain a long-term perspective. We offer a free initial financial planning consultation so you can discuss your financial needs with a qualified financial adviser. It is never too late to start planning for your financial future, and if you are approaching your retirement you might benefit from financial advice to ensure you have enough money to live on when you give up work. For more information on equity investing call our Thomas Oliver financial planning team on 01707 872000.

In Summary...

Don’t try and time the markets as it is often difficult to time your re-entry. We recommend investing over the long-term, at least five years.

Please note: The value of your investment can fall as well as rise and is not guaranteed.

Source – Omnis 26 August 2021 | Investment perspectives