Need a new mortgage? Review our best mortgage rates

Monday 21 June, 2021

If you want to move house before the Stamp Duty holiday ends and you are looking for a mortgage option, review our best mortgage rates below. Please note that these rates are not available after 9th June 2021, but they give you an indication of the types of mortgage rate available. For more information call our mortgage brokers on 01707 872000. Our mortgage brokers will check the mortgage market and find the best available rates for you.

Mortgage Option 1

£150,000 loan with a 25-year term

Fixed rate of 1.19% until 31.07.23

Monthly Payment £148.75

Early repayment charges will apply until 31.07.23

The overall cost for comparison is 4.5% APRC

For an interest only mortgage you would pay 25 payments at a cost of 1.19% with monthly payments of £148.75, followed by 275 payments at a variable rate which is currently 4.74% with monthly payments of £592.50. Total amount payable £320,106.

The illustration is based on an interest only mortgage.

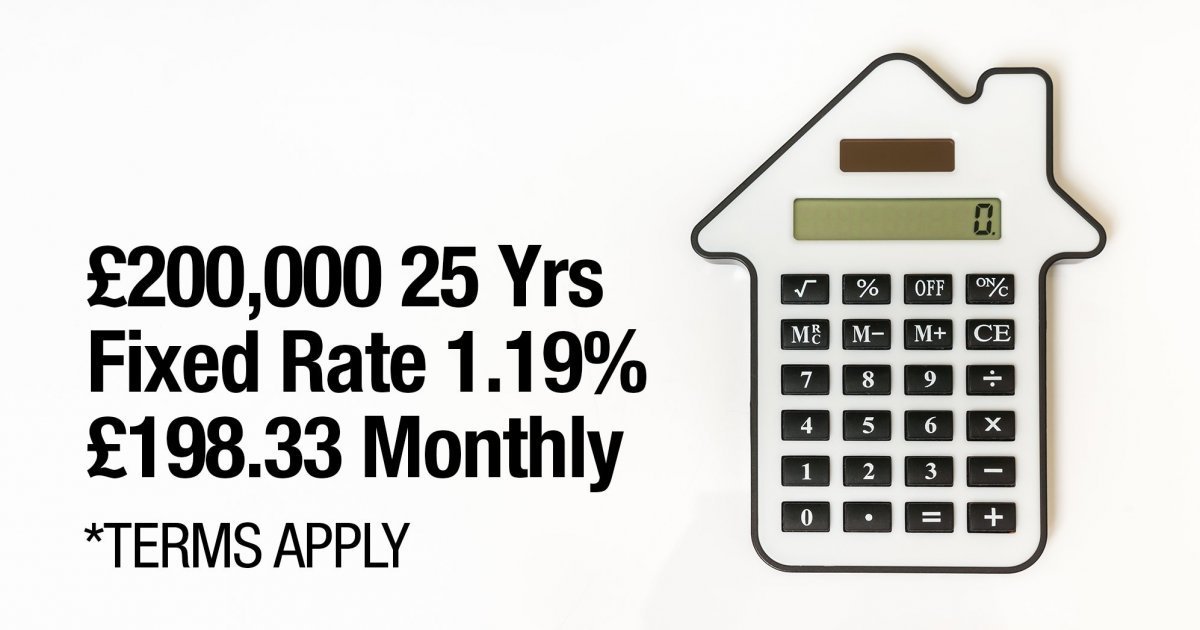

Mortgage Option 2

£200,000 loan with a 25-year term

Fixed rate of 1.19% until 31.07.23

Monthly Payment £198.33

Early repayment charges will apply until 31.07.23

The overall cost for comparison is 4.5% APRC

For an interest only mortgage you would pay 25 payments at a cost of 1.19% with monthly payments of £198.33, followed by 275 payments at a variable rate which is currently 4.74% with monthly payments of £790.00. Total amount payable £426,723

The illustration is based on an interest only mortgage and are available until 9th June 2021.

Thomas Oliver provides mortgage advice for the following services:

- Mortgages

- Remortgages

- Product Transfer

- Further Advances

- Interest Only Mortgages

- Repayment Mortgages

- Variable Mortgages

- Tracker Mortgages

- Fixed Mortgages

Tracy Dove, Mortgage Broker in Basildon, Essex and Exeter, Devon, Hertfordshire said:

‘The mortgage rates currently available are low relative to rates available pre the pandemic. There has been significant interest in moving house because of these low mortgage rates and the Stamp Duty holiday. Many clients are looking to move home and re-mortgage. We have also had significant interest from first-time buyers and buy-to-let investors who are looking for property. The Stamp Duty holiday is due to end on June 30th 2021, so we recommend anyone in a position to move secures a mortgage deal quickly. If you haven’t yet started looking for a property, call our Thomas Oliver mortgage broking team on 01707 872000. They can discuss your mortgage options and the various mortgage products that are available to you. By reviewing your income and expenses they will be able to let you know how much you can borrow and recommend the best mortgage product for your circumstances. Our mortgage consultants can also review the mortgage market and find you the best available mortgage deal saving you time and money.’

Your property may be repossessed if you do not keep up repayments on your mortgage. Thomas Oliver UK LLP are appointed representatives of Openwork Limited which is authorised and regulated by the Financial Conduct Authority.