Review our best buy-to-let mortgage options available until 23/12/20

Thursday 5 November, 2020

If you are a buy-to-let investor requiring a commercial mortgage or you are a homeowner, wanting remortgaging advice review our mortgage options below. Contact our mortgage broking team now on 01707 872000 for expert mortgage advice..

Mortgage Option 1

£150,000 loan with a 25-year term

Fixed rate of 1.19% until 30.11.22

Monthly Payment £148.75

Early repayment charges will apply until 30.11.22

The overall cost for comparison is 4.5% APRC

For an interest only mortgage you would pay 25 payments at a cost of 1.19% with monthly payments of £148.75, followed by 275 payments at a variable rate which is currently 4.74% with monthly payments of £592.50. Total amount payable £320,106.

The illustration is based on an interest only mortgage.

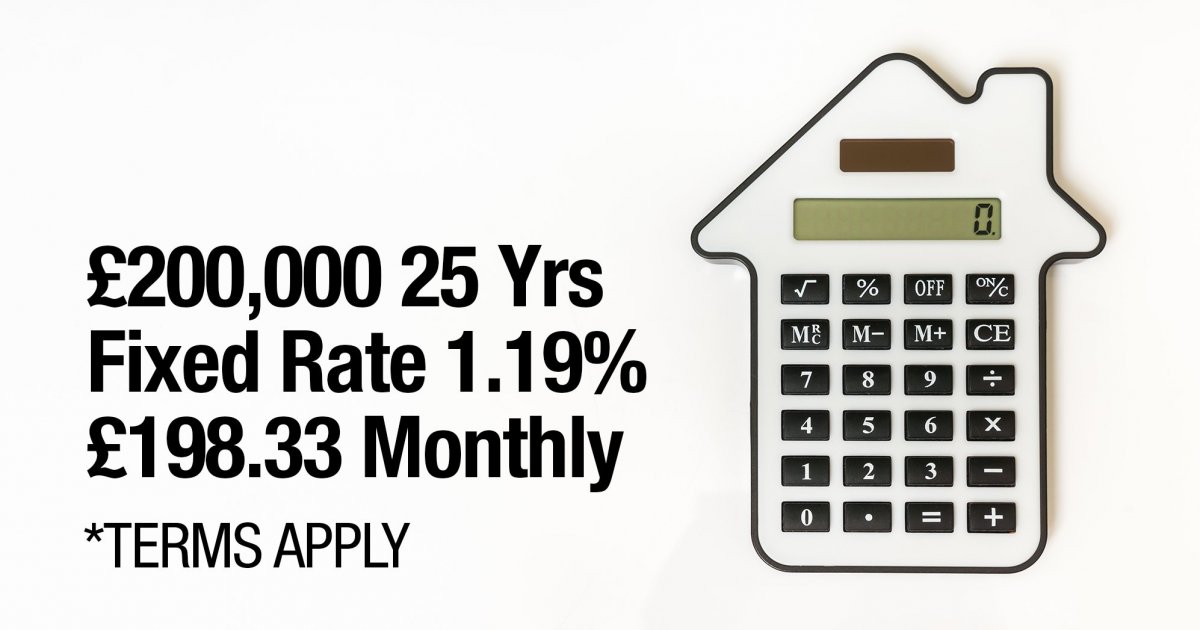

Mortgage Option 2

£200,000 loan with a 25-year term

Fixed rate of 1.19% until 30.11.22

Monthly Payment £198.33

Early repayment charges will apply until 30.11.22

The overall cost for comparison is 4.5% APRC

For an interest only mortgage you would pay 25 payments at a cost of 1.19% with monthly payments of £198.33, followed by 275 payments at a variable rate which is currently 4.74% with monthly payments of £790.00. Total amount payable £426,723.

The illustration is based on an interest only mortgage.

Thomas Oliver provide the following services in relation to buy-to-let mortgages and re-mortgages:

- Mortgages

- Remortgages

- Product Transfer

- Further Advances

- Interest Only Mortgages

- Repayment Mortgages

- Variable Mortgages

- Tracker Mortgages

- Fixed Mortgages

James Ashaye, Mortgage Advisor in Edmonton, North London said:

‘We work with a variety of clients including first time buyers, but to let investors, home movers and anyone re-mortgaging. We always remind our mortgage clients and anyone calling us for mortgage advice that these figures are only mortgage illustrations. Please note if you are reading this after 15thOctober 2020 these rates are no longer available. Rates can change daily so remember you will get the mortgage rate that is available when you apply for your mortgage. We recommend that you contact a Thomas Oliver mortgage broker before you start looking for a home to purchase so we can work out how much you can borrow. This figure will be based on your current income and expenditure. If you want to re-mortgage, please contact one of our mortgage advisers three months before your mortgage deal renews so that we can organise your re-mortgage and you can switch to your new mortgage deal on time.’

James Ashaye, Mortgage Advisor in Edmonton, North London said:

‘Our mortgage broking team offer a free initial mortgage advice consultation so please contact one of our North London mortgage advisors on 01707 872000. We work with our clients so they can complete their mortgage quickly which saves them time. By reviewing their personal situation, we hope to save them money by finding a mortgage product that is most suitable for their needs. Our mortgage brokers work with our mortgage clients to assist them while their mortgage completes. We can help clients with their mortgage application, liaise with their mortgage provider and their solicitor so their mortgage application progresses quickly. This year Thomas Oliver has been nominated as a finalist for the 2020 British Mortgage Awards, in the Business Leaders category for mortgage brokers with between 11 and 50 mortgage advisers. The awards will be announced in December 2020.’

Your property may be repossessed if you do not keep up repayments on your mortgage. Thomas Oliver UK LLP are appointed representatives of Openwork Limited which is authorised and regulated by the Financial Conduct Authority.